Solar in Ohio

Ohio residents are buying residential solar faster than ever before.

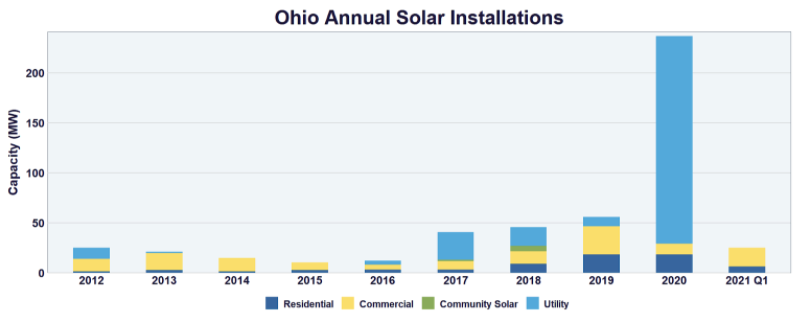

Solar energy is already being embraced in the state of Ohio, and these numbers are only projected to increase. Ohio has committed to producing 12.5% of its electricity through renewable resources by 2027. According to the Solar Energy Industries Association (SEIA), solar in Ohio as of 2021:

- Solar installed: 527.1 MW

- Number of Installations: 8,341

- Enough solar installed to power: 63,137 homes

- Solar jobs: 6,532

- Solar Companies in the state: 238

- Total solar investment in the state: $1.3 billion

- Prices have fallen: 43% over the last 5 years

- Growth projections and ranking: over the next 5 years, 2,955 more MW installed, bringing the ranking of Ohio down to 11th from its current ranking of 25th

Does solar work in Ohio?

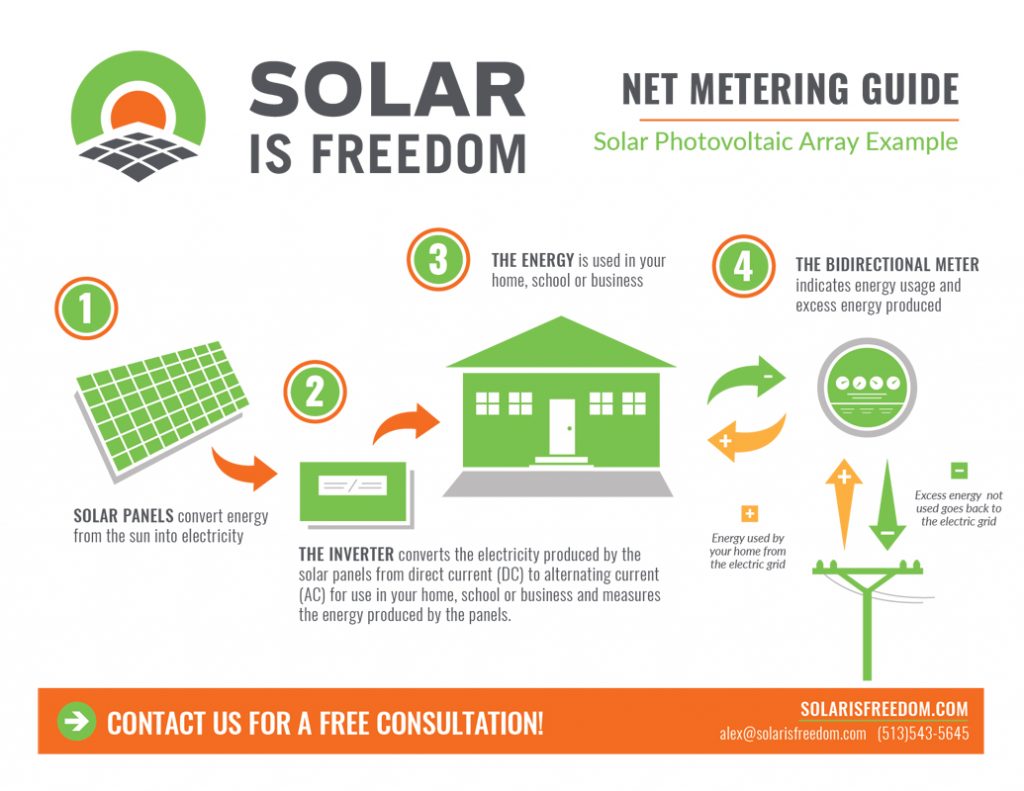

As anyone living in the Midwest knows, the weather varies pretty considerably throughout the days, weeks, months, and years. This makes many homeowners a bit apprehensive as to if solar will work for their homes. However, even with highly variable weather, solar energy works for all due largely to net metering! Here’s how it works: during the day when the sun is shining, solar arrays in Indiana capture energy from the sun and convert it to the energy that the building can use. It is likely that at this time, arrays will generate more energy than is needed. For buildings that are net-metered, the electricity meter will run backward to provide a credit for times when there is bad weather, during the nighttime, or any time when the electricity used exceeds what the system is producing. This means that even during bad weather or nighttime, your solar array and utility company have got you covered. The use of battery storage has also rapidly gained popularity throughout the United States. Battery storage works by storing the excess energy that the solar array generates during peak production hours. During nighttime or when the weather is poor, the array will simply pull energy from the battery to power the building. With a battery storage system, homeowners can gain energy independence by removing their reliance on their utility company and the grid, which is highly unreliable. It also gives homeowners peace of mind knowing that no matter what inclement weather may come their way, they will have energy created by their solar panels stored away for use, while those without solar are vulnerable to climatic episodes that could cause the grid to be inoperable. With net metering and battery storage, solar is a huge asset to homeowners in Ohio.

Although solar makes sense in Ohio, and the state is seeing huge increases in solar investments, Ohio solar homes still only make up about 2% of the total home market in the state. The cities of Cincinnati, Columbus, and Cleveland all have carbon goals, with Cincinnati investing in over 300,000 panels to take control of the city’s energy future. Local governments and companies are seeing the light and investing, and residents of Ohio should continue to follow this example. The average homeowner in Ohio saves tens of thousands throughout the life of the system. Beyond just the savings, Ohioans value self-reliance and freedom. Solar ownership means equity in energy, exemplifying these values. Solar also lessens Ohio’s reliance on finite resources, reduces greenhouse gas emissions which leads to cleaner, healthier communities, and adds property value.

Benefits of owning solar in Ohio

Enhances home value: In addition to drastically lowering or removing your electric bill, adopting a solar PV system increases the value of your home. This is true due to solar increasing the resale value of your home and while also reducing the amount of time it takes to sell your home.

Affordability: As previously mentioned, solar prices are the lowest they have ever been, as they have decreased by 43% over the last 5 years. Reports have found that local solar truly costs less for all. This is also reflected in the wide variety of solar owners, including many low-to-moderate income households. With technologies that are constantly improving and considerable tax benefits, solar energy has never been more affordable in Indiana.

Ohio solar incentives: One of the biggest benefits of installing solar in Ohio is the state’s use of solar renewable energy certifications (SRECs). For every megawatt-hour (MWh) of energy an array produces, the owner will be given one SREC that can be sold for extra cash. This means that while the array is providing the home with electricity and offsetting electricity usage, it is also earning additional income.

Federal tax benefits: Towards the end of 2020, Congress passed an extension of the federal investment tax credit (ITC). The ITC provides a 26% tax credit for solar systems installed before 2022. This rate will decrease to 22% in 2023, echoing again that the time for solar is now!

Solar Is Freedom®

In just a few short years, Solar Is Freedom® has become one of the best solar installers in the states of Ohio, Kentucky, and Indiana. SIF has grown exponentially, with offices in Cincinnati, OH, Columbus, OH, and Louisville, KY. However, the midwest is slow to adopt solar in large numbers. Meaning everyone who lives in Ohio now can still take advantage of outstanding incentives and can benefit before it comes to a necessity. Solar Is Freedom® has a 5-star rating with hundreds of satisfied customers who continually refer their friends and family members. If you are interested in discussing the potential of solar for your home, contact us today for a free, no commitment, consultation.

Resources for solar in Ohio:

Solar Rebates and Incentives in Ohio

State Energy Profile from the US Energy Information Administration for Ohio